Last updated on December 23rd, 2024 at 03:06 pm

Get the latest CDSL share price forecast for 2025 and 2030. Discover insights on CDSL's growth potential on moneyphobia.in.

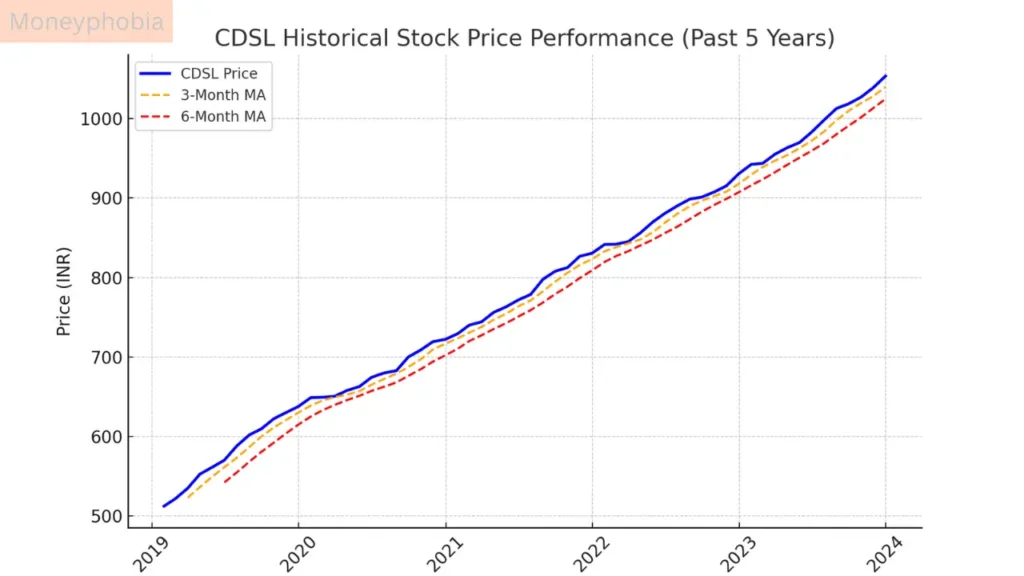

Sensing optimism in the depository business of India, investors have shown interest in the company CDSL or Central Depository Services Limited. Being the single depository listed in India, CDSL is popular among those who are interested in the long term development of Indian financial markets. This article will also consist of the share price targets for 2025 and 2030 with company analysis, bonus shares, results, and the best Demat account service providers in India. For those interested in the specifics of CDSL’s future performance, read on then. To learn more updated finance news and stock analysis visit moneyphobia.in.

About

CDSL was incorporated in 1999; it is one of the two Depositories in India and the other being the National Securities Depository Limited – NSDL. Most important services offered by CDSL include holding of its customers securities and transfer of these securities. Securities in the form of stocks, bonds, mutual and other investment instruments can be comfortably kept electronically by the investors. This also reduces the dangers of having actual certificates and makes the entire course much smoother as well. These years, it has expanded its scale due to the rising number of Demat account holders in India, which determines its revenue.

CDSL Share Price Target for 2025

Therefore, the growth of CDSL’s stock price could significantly be by 2025. Key factors that may influence this increase include:

- Growing Demat Accounts: There are more and more people in India investing in shares. Since, there are more number of Demat accounts, CDSL’s clients would grow which in turn, will add to its revenues.

- Technological Advancements: CDSL is on the move all the time. The company introduced some new services for the investors which may bring them more clients and improved the financials.

- Government’s Push for Digital India: Factors that beneficial for CDSL are Digital India, growing financial education and literacy amongst citizens.

CDSL Share Price Target 2025:

- Minimum Target: Rs 1,500

- Maximum Target: Rs 1,700

CDSL Share Price Target for 2030

Hoping for a longer-term view, the prognosis for 2030 is also quite positive. CDSL would be in a position to reap from increasing Indian involvement within the stock market the emerging digital financial industry.

- More Participation in the Stock Market: There is potential added involvement that the public will have with the stock market by 2030 which will increase the customer base for CDSL and thus increase its revenues.

- Expansion of Services: New services such as kyc records, e-voting, insurance dematerialization etc have been being added to CDSL which offer fresh sources of revenues.

- Stable Financial Health: Our research shows that CDSL has been maintaining a stable growth rate with very low leverage ratios; this means that the company can stand some shocks.

CDSL Share Price Target 2030:

- Minimum Target: Rs 2,500

- Maximum Target: Rs 3,000

CDSL Share Price Target 2024 to 2030

| Year | Minimum Target Price (₹) | Maximum Target Price (₹) |

|---|---|---|

| 2024 | 1,200 | 1,400 |

| 2025 | 1,500 | 1,700 |

| 2026 | 1,800 | 2,100 |

| 2027 | 2,200 | 2,500 |

| 2028 | 2,700 | 3,000 |

| 2030 | 2,500 | 3,000 |

CDSL Company Analysis

CDSL has built a strong reputation in India’s financial market infrastructure. Here’s a breakdown of CDSL’s current strengths:

- Revenue Growth: CDSL has its principal income stream from account maintenance charge, transaction charges, and K Y C services. It is worth to mention that its revenue has been increasing during the last several years.

- Low Debt: CDSL does not have high debts and therefore during recession period, it is able to perform well than those companies with high debts.

- Regulatory Position: CDSL is one of India’s financial service providers, thus has backing from government regulatory bodies and established itself in the depository business.

CDSL Bonus Shares: What to Know

Additional shares are additional shares given out by the company to some of its existing shareholders. The latest news from CDSL that it has declared bonus share has brought interest. Here are some key points about the CDSL bonus shares:

- Bonus Share Ratio: Currently CDSL issued one bonus share which equally means that every ordinary shareholders will receive one additional share for every share he or she is holding.

- Crediting Date: The management said that bonus shares would be placed to shareholders in the predetermined period of time. This is the date for bonus share credit, the latest of which are available at CDSL or at moneyphobia.in for the latest news.

For long term investor, bonus shares are perfect for increasing the amount of share holding without having to spend any money.

Recent CDSL Results

The rise in Demat accounts and digitalisation in the financial services have ultimately contributed to the consistent performance of the quarterly and annual results that CDSL has shown over the years. Some key highlights of CDSL’s latest financial results include:

- Revenue Growth: Increased investor participation and new services helped CDSL record year-on-year growth in revenue.

- Profitability: Profits for CDSL have also risen indicating efficient management and a stable cost structure.

- Future Outlook: The CDSL has a good future ahead in coming quarters with the plan to introduce more digital services to attract more investors.

Best Demat Account in India: Why CDSL is a Top Choice

Demat accounts backed by CDSL are considered the best for investors. Here’s why:

- Wide Network: A CDSL Demat account is provided through large banks and financial institutions which are present all over in India so that investors can easily avail them.

- Security and Convenience: Electronic depository services offered by CDSL offer secure, convenient management of securities without the burden of physical certificates.

- Cost-Effectiveness: Many investors know the fact that the CDSL-backed Demat accounts have competitive fees, resulting in both experienced and new investors benefitting from these accounts.

CDSL has a solid foundation and strong financials, making it a potential long-term investment option. However, always conduct thorough research or consult a financial advisor before making investment decisions.

Stay updated on CDSL’s growth, financial results, and more by following moneyphobia.in for reliable, detailed finance news and analysis.