Last updated on December 23rd, 2024 at 03:16 pm

Ethereum has recently seen a flurry of predictions about its future price. One of the most talked-about is from a popular crypto analyst who forecasts that Ethereum (ETH) could hit $10,000 in the near future. This prediction is sparking a lot of buzz in the crypto community, especially as Ethereum’s price hovers around the $3,100 mark.

Ethereum’s Bold $10K Price Prediction

A well-known crypto analyst, Ali Martinez, has recently made a bold prediction that Ethereum will soon hit $10,000. His prediction is based on the historical market trends where Ethereum has previously outperformed Bitcoin. Martinez believes that ETH’s price will rally in a similar fashion to the S&P 500, driven by increasing whale activity and positive on-chain metrics.

Ethereum’s Strong Support at $3,000

Despite a recent dip in price, Ethereum has shown resilience by holding strong support around the $3,000 mark. Over 2.82 million addresses are holding a total of 6.14 million ETH coins at this level, suggesting that there is still significant demand for Ethereum. Even after a 10% correction from its November highs of $3,400, the bulls have managed to defend the $3,000 support zone, providing a foundation for potential price growth.

Twitter Insights: A Look at Ethereum’s Long-Term Potential

On Twitter, crypto analyst Ki Young Ju shared an interesting observation about Ethereum’s performance. He pointed out that the ETH-BTC NUPL (Net Unrealized Profit/Loss) is at a 4-year low. This suggests that many ETH holders are enduring losses without selling, which mirrors levels from the early 2020 bottom. Some investors view this as a potential buying opportunity before Ethereum’s price begins to rally.

ETH-BTC NUPL hits a 4-year low.

— Ki Young Ju (@ki_young_ju) November 20, 2024

Despite #Ethereum's underperformance against #Bitcoin, ETH holders endure losses without realizing them. This mirrors levels from its early 2020 bottom.

This might be an opportunity for ETH believers. pic.twitter.com/NhoEfkp0r8

Ethereum Faces Short-Term Struggles

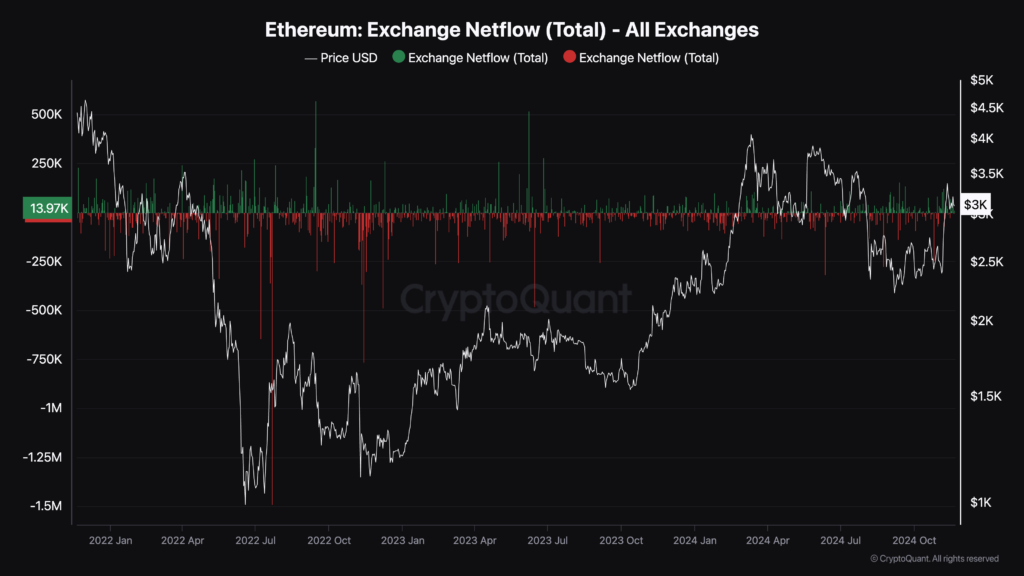

While there is a lot of optimism around Ethereum’s long-term prospects, the price has struggled to keep up with Bitcoin and other altcoins. In the past week, ETH dropped by 6%, trading at around $3,123. The main reason for this lack of momentum is a combination of low demand and high selling pressure, preventing Ethereum from breaking out of its bearish trend.

Speculative Activity Drives Ethereum’s Derivative Market

Speculative activity in Ethereum’s derivative market has been on the rise. Ethereum reserves on derivative exchanges have surged to the highest level in over a year, reflecting increased trading interest. Open interest is also at its highest since April, signaling that more traders are betting on Ethereum’s future price moves. With more traders taking long positions than short, the market appears to have a bullish bias for the short-term outlook.

The Risks of Speculative Trading and Market Sentiment

Despite the surge in derivative trading, Ethereum’s overall market sentiment remains somewhat bearish. Data from Market Prophit suggests that investor sentiment is leaning toward the downside, which could make it harder for Ethereum to break free from its current bearish trend. Additionally, the rise in leveraged trading could introduce volatility, as forced liquidations could cause significant price fluctuations

Social Sentiment & Buzz

Will Ethereum Reach $10K?

Ethereum’s price may face challenges in the short term, but the long-term outlook is looking more promising. Whale activity, speculative trading, and strong support at the $3,000 mark are all factors that could drive ETH to new heights. If Ethereum can break through the $4,000 level and maintain momentum, the $10,000 target might not be so far-fetched after all.

In the coming months, investors will be closely watching Ethereum’s price movements. The next key levels to watch are $4,000 and $6,000, as Ethereum could potentially test these targets before making its move toward $10,000. Only time will tell if ETH can overcome its current struggles and set a new record.

For more updates on Crypto and related news, check out other articles on Moneyphobia.in.