Last updated on December 19th, 2024 at 09:00 pm

Large and mid-cap IT stocks have once again caught the eye of investors, as Morgan Stanley released its latest recommendations. On September 4, 2024, the global financial services giant urged investors to hold on to their IT stocks, emphasizing that it is not yet time to reduce exposure to the sector. According to Morgan Stanley, IT stocks still hold significant potential, and they are maintaining their overweight positions on key players in the industry.

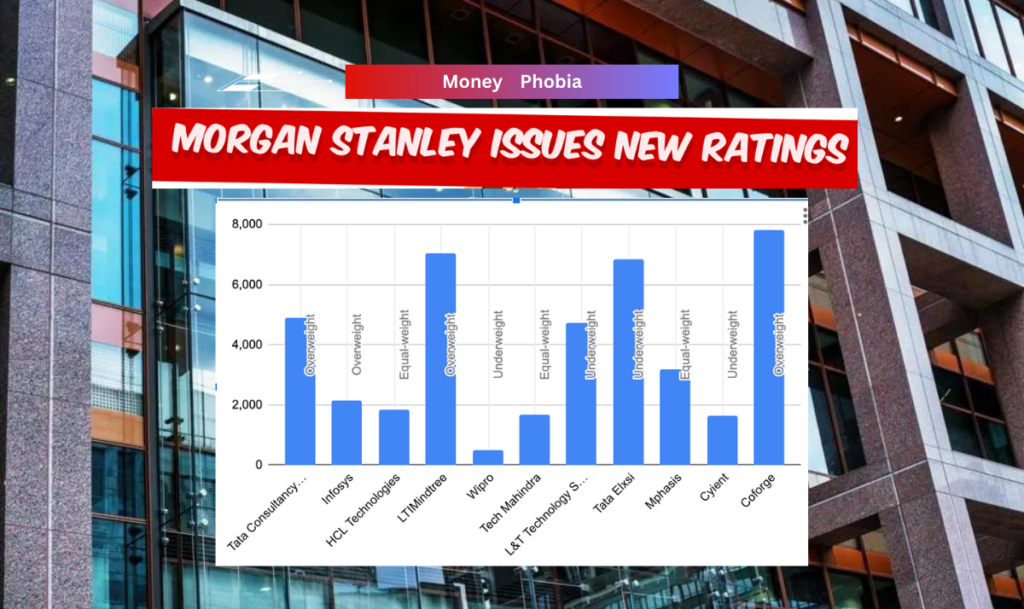

Morgan Stanley’s Ratings and Target Prices

Morgan Stanley’s report provided a detailed assessment of several prominent IT companies, offering guidance on how investors should approach these stocks. Below is a summary of the ratings and target prices provided:

- Tata Consultancy Services (TCS): Morgan Stanley has given TCS an “Overweight” rating, with a target price of ₹4,910. The firm believes TCS remains a strong player in the IT sector, with potential for further growth.

- Infosys: Infosys has also been rated “Overweight” by Morgan Stanley, with a target price of ₹2,150. This suggests that Infosys is expected to perform well in the coming months.

- HCL Technologies: HCL Technologies received an “Equal-weight” rating, with a target price of ₹1,840. This indicates that the stock is fairly valued at its current level, and investors might not see significant movement either way.

- LTIMindtree: LTIMindtree is another stock that has been rated “Overweight,” with a target price of ₹7,050. Morgan Stanley sees potential for growth in this company as well.

- Wipro: Wipro, on the other hand, received an “Underweight” rating, with a target price of ₹500. This suggests that Wipro may underperform compared to its peers, and investors might want to reconsider their positions in this stock.

- Tech Mahindra: Tech Mahindra has been rated “Equal-weight,” with a target price of ₹1,680. Like HCL Technologies, this indicates a neutral outlook on the stock.

- L&T Technology Services (L&T Tech): L&T Tech received an “Underweight” rating, with a target price of ₹4,730. This suggests that the stock may not offer much growth potential in the near term.

- Tata Elxsi: Tata Elxsi was also rated “Underweight,” with a target price of ₹6,860. Morgan Stanley’s cautious outlook on this stock might be a sign for investors to look elsewhere.

- Mphasis: Mphasis received an “Equal-weight” rating, with a target price of ₹3,200. The stock is expected to maintain its current performance level.

- Cyient: Cyient was rated “Underweight,” with a target price of ₹1,650. The stock may not see much growth, according to Morgan Stanley.

- Coforge: Coforge received an “Overweight” rating, with a target price of ₹7,825. This indicates that Morgan Stanley sees significant upside potential in this stock.

What Does This Mean for Investors?

Morgan Stanley’s ratings suggest a mixed outlook for the IT sector. While companies like TCS, Infosys, and LTIMindtree are expected to perform well, others like Wipro, L&T Tech, and Cyient may struggle. Investors should consider these ratings carefully when making decisions about their IT portfolios.

The “Overweight” ratings for TCS, Infosys, LTIMindtree, and Coforge indicate that Morgan Stanley expects these stocks to outperform the broader market. This could be a signal for investors to maintain or increase their positions in these companies. On the other hand, the “Underweight” ratings for Wipro, L&T Tech, Tata Elxsi, and Cyient suggest that these stocks may underperform, and investors might want to proceed with caution.