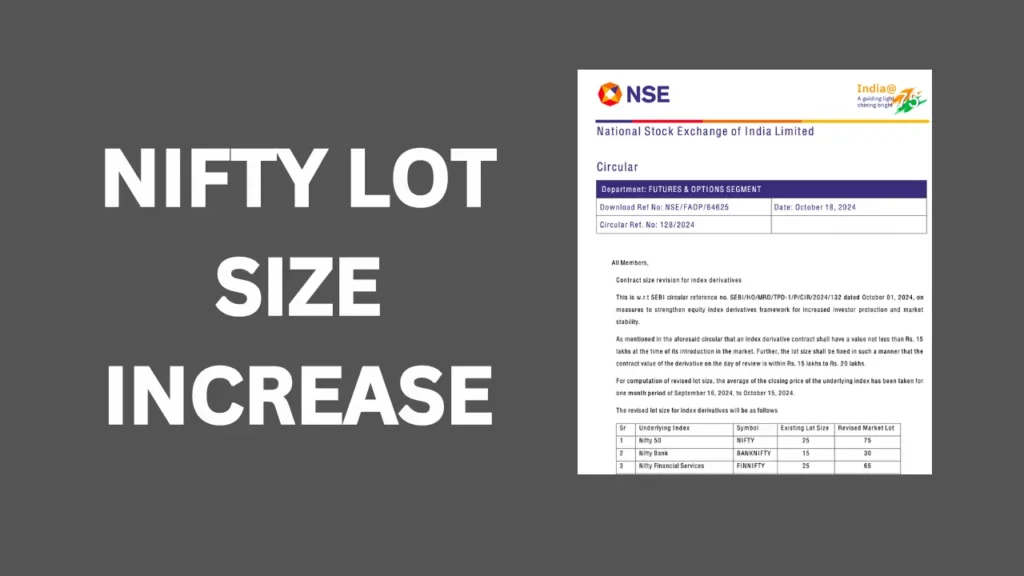

NSE on 18th Oct 2024 announced some bad news for the traders that is really going to shake a lot of them. They’re changing the contractual value units for index derivatives. Well, this is not such a random shift. It is actually in line with a much broader scheme that SEBI put in action with their circular from October 1, 2024. The whole idea is to try and reduce the risk and make investing a little less risky and therefore adding more structure to the markets.

Here’s what is going down. With passing of new rules empowered by SEBI,now,any index derivative contract ‘s price should be Rs. 15 lakhs at least when it will be listed. And the lot sizes? They have to be set that the value of the contract should be lying between Rs. 15 lakhs and Rs. 20 lakhs during the review.

For Advertising, Guest Posting, Newsletter Inserts please contact [email protected]. For general enquiries contact [email protected].