A Calendar Spread strategy is a popular options trading approach that involves selling a near-month option and buying a far-month option with the same strike price. This strategy is primarily used to capitalize on time decay and volatility changes in the market. In this article, we’ll backtest a Monthly Calendar Spread strategy using real market data from January to February 2024.

Trade Setup

We initiated the trade on January 29, 2024, at 10:50 AM, the next trading day after the Nifty’s expiry. Our chosen options were as follows:

- Sell:

- February Expiry (29 Feb 2024): 20900 PE at ₹110 LTP and 22500 CE at ₹99 LTP.

- Buy:

- March Expiry (28 Mar 2024): 21100 PE at ₹221 LTP and 22500 CE at ₹223 LTP.

The idea behind this setup is to sell the options with a near expiry, benefiting from the rapid time decay while protecting the position by buying options with a longer expiry.

Initial Market Movements

By February 2, 2024, the market showed favorable movements:

- P&L: ₹30,000 (4.8%)

- Max Profit: ₹1.23L (19.5%)

- Max Loss: Undefined

- Probability of Profit (POP): 77.38%

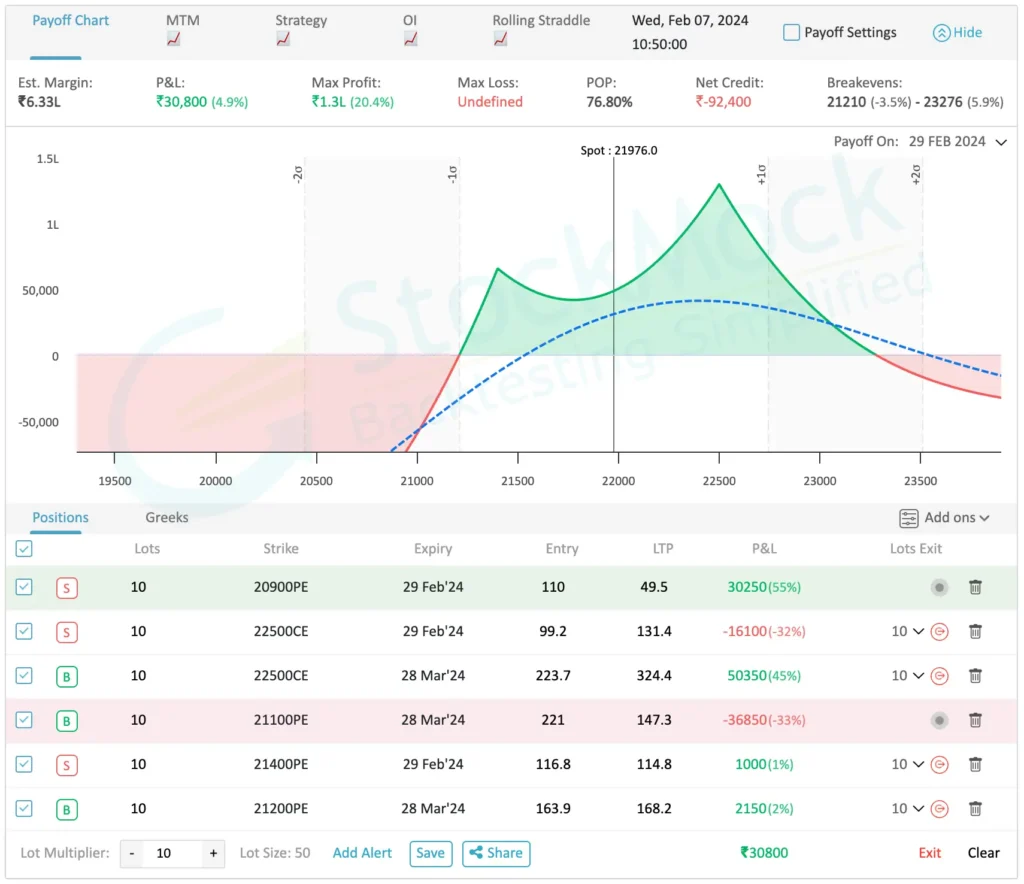

Wed, Feb 07, 2024

However, on February 9, 2024, there was a notable drop in P&L:

- P&L: ₹9,300 (1.5%)

- Max Profit: ₹1.21L (19.3%)

- Max Loss: Undefined

- POP: 71.44%

This decline indicated a need for adjustments to maintain the strategy’s profitability.

First Adjustment (February 9, 2024)

We decided to adjust the position due to the 50% variation in the call option. The steps were:

- Exit:

- 22900 PE at ₹49 LTP.

- 21100 PE at ₹147 LTP.

- Add:

- Sell: 21400 PE at ₹116 LTP (29 Feb Expiry).

- Buy: 22300 PE at ₹277 LTP (28 Mar Expiry).

Post-adjustment, the strategy showed the following results by February 12, 2024:

- P&L: ₹16,900 (2.6%)

- Max Profit: ₹1.06L (16.3%)

- Max Loss: Undefined

- POP: 64.20%

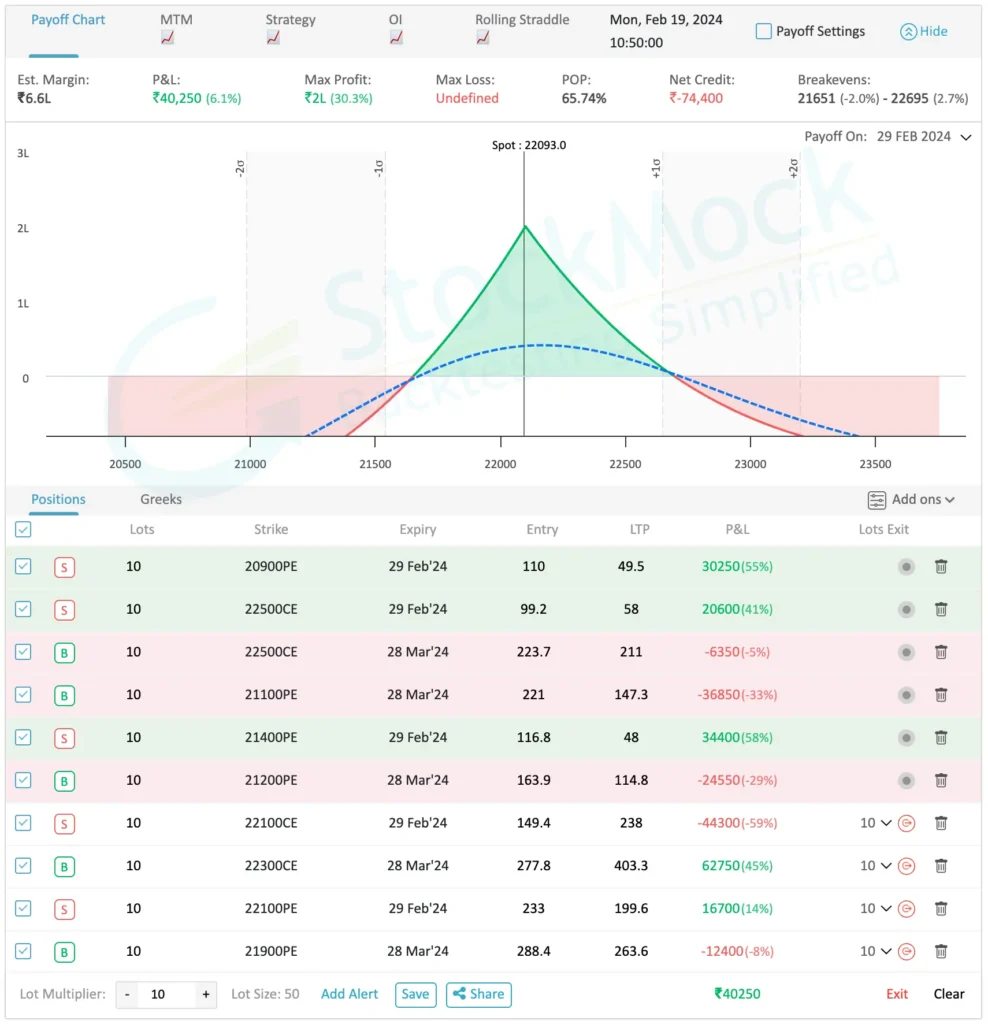

Further Adjustments (February 16, 2024)

As the market continued to move, another adjustment was needed on February 16, 2024:

- Exit:

- 21400 PE at ₹48 LTP.

- 21200 PE at ₹114.8 LTP.

- Add:

- Sell: 21100 PE at ₹233 LTP (29 Feb Expiry).

- Buy: 21900 PE at ₹288.4 LTP (28 Mar Expiry).

This adjustment resulted in a stronger position with the following metrics by February 19, 2024:

- P&L: ₹40,250 (6.1%)

- Max Profit: ₹2L (30.3%)

- Max Loss: Undefined

- POP: 65.74%

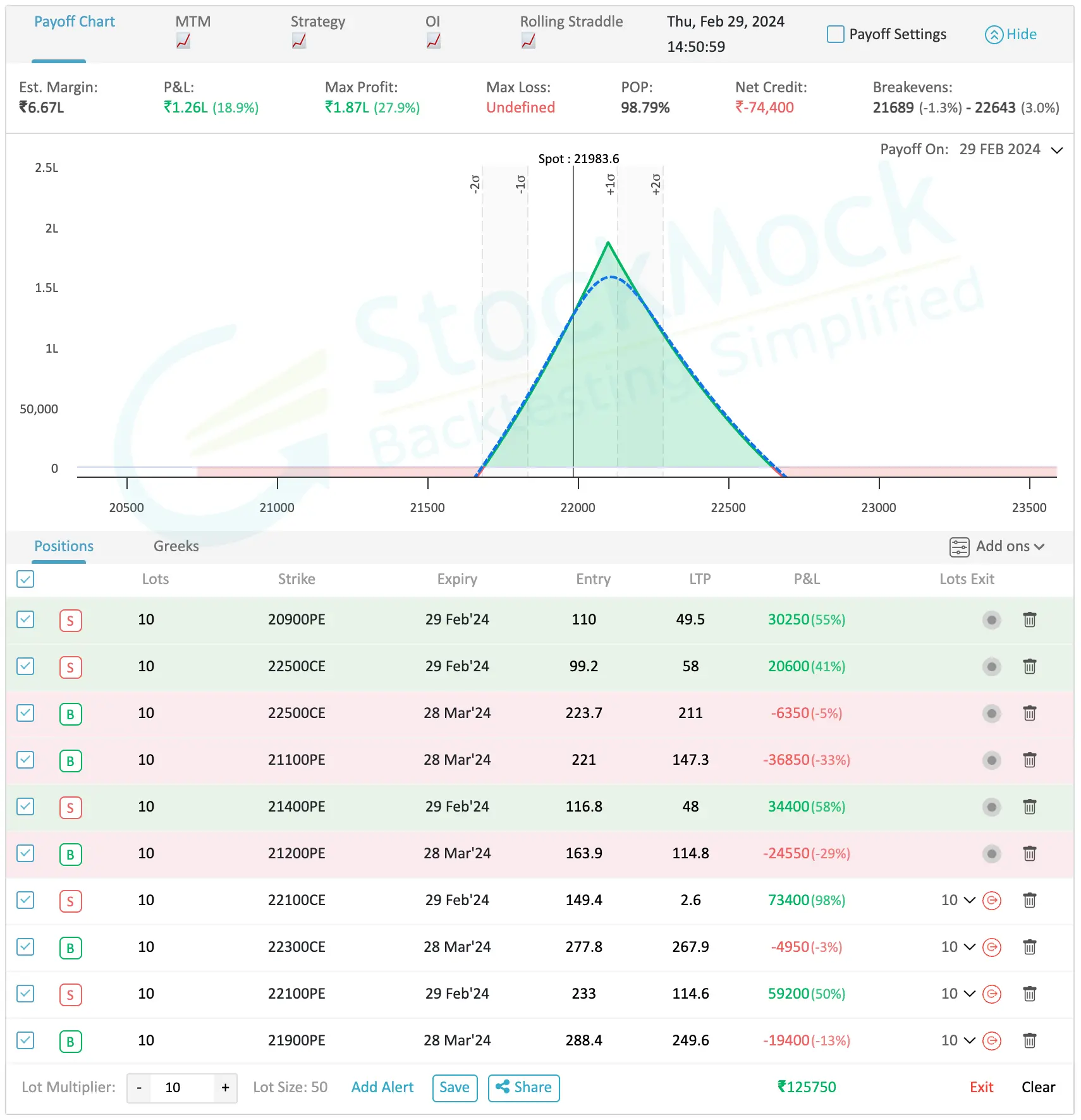

Final Results (February 29, 2024)

By the end of the month, on February 29, 2024, the strategy achieved:

- P&L: ₹1.26L (18.9%)

- Max Profit: ₹1.87L (27.9%)

- Max Loss: Undefined

- POP: 98.79%

Key Takeaways

- Profitability: The Calendar Spread strategy demonstrated solid profitability, particularly when actively managed with timely adjustments. Booking profits early at around 3-4% is often safer than holding for maximum gains, as shown by the final P&L.

- Risk Management: Adjustments were crucial in maintaining the trade’s success, especially when there were significant movements in the market. The approach of exiting underperforming positions and adding new ones helped in locking in profits and reducing risk.

- Volatility Impact: The strategy benefits from a stable or mildly volatile market. High volatility can affect both the POP and P&L, requiring more frequent adjustments.