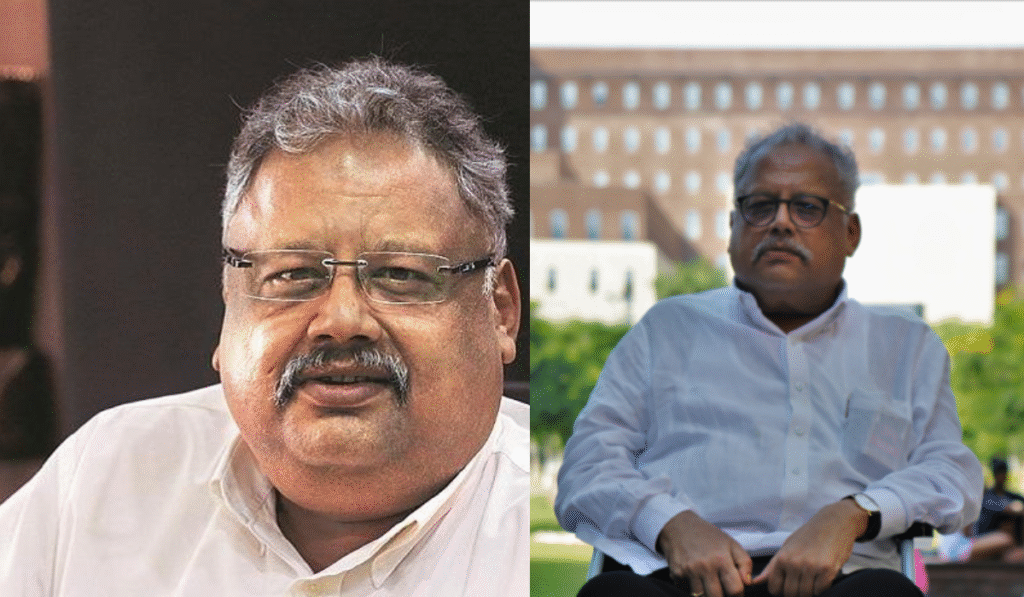

Rakesh Jhunjhunwala: Net Worth, Portfolio, Life Story, and His Everlasting Legacy

Rakesh Jhunjhunwala was one of India’s most legendary stock market investors. Born on July 5, 1960, and passing away on August 14, 2022, his journey from a middle-class background to becoming a billionaire investor continues to inspire many in the world of finance. This article explores his net worth, portfolio, investment mindset, education, daily income, and more.

About Rakesh Jhunjhunwala

Known as the “Big Bull” or “India’s Warren Buffett,” Rakesh Jhunjhunwala made his name by investing smartly in undervalued stocks. His deep understanding of the market, combined with patience and confidence, turned him into a financial icon.

| Category | Details |

|---|---|

| Name | Rakesh Jhunjhunwala |

| Born | July 5, 1960 |

| Died | August 14, 2022 |

| Profession | Investor, Trader, Chartered Accountant |

| Famous For | Long-term stock market investments |

| Education | Chartered Accountant (ICAI) |

| Company | Rare Enterprises |

| Net Worth (2022) | Approx ₹46,000 crore |

| Per Day Income (Est. 2022) | ₹15-20 crore/day |

Rakesh Jhunjhunwala Net Worth

At the time of his death in 2022, Rakesh Jhunjhunwala net worth was estimated at around ₹46,000 crore (approximately $5.8 billion USD). That means Rakesh Jhunjhunwala’s per day income was nearly ₹15 to ₹20 crore, thanks to the surge in value of his long-term holdings and profits from trading.

As per Forbes India, his estimated net worth in 2022 was around $5.8 billion (₹46,000+ crore).

He had stakes in over 30 companies through his privately owned stock trading firm, Rare Enterprises—named after him and his wife (RA for Rakesh, RE for Rekha).

Rakesh Jhunjhunwala Portfolio (2025)

His portfolio was a mix of long-term investments and high-potential picks. Some of the most famous Rakesh Jhunjhunwala stocks included:

| Stock Name | Holding Value |

|---|---|

| Aptech | ₹344.7 Cr |

| Canara Bank | ₹1,550.0 Cr |

| Escorts Kubota | ₹573.5 Cr |

| NCC | ₹1,792.8 Cr |

| Titan Company | ₹15,649.0 Cr |

| Raghav Productivity Enhancers | ₹155.0 Cr |

| Sundrop Brands | ₹168.2 Cr |

| Autoline Industries | – |

| Crisil | ₹2,252.0 Cr |

| Valor Estate | ₹600.6 Cr |

| Federal Bank | ₹773.5 Cr |

| Fortis Healthcare | ₹2,444.2 Cr |

| Geojit Fin Serv | ₹152.4 Cr |

| Indian Hotels Company | ₹2,164.3 Cr |

| Jubilant Pharmova | ₹1,223.6 Cr |

| Karur Vysya Bank | ₹917.6 Cr |

| Rallis | – |

| Sun Pharma Advanced | – |

| Tata Communications | ₹776.0 Cr |

| Tata Motors | ₹3,243.6 Cr |

| Va Tech Wabag | ₹731.0 Cr |

| Wockhardt | ₹516.6 Cr |

| Singer | ₹28.5 Cr |

| Nazara Technologies | ₹855.8 Cr |

| Jubilant Ingrevia | ₹388.8 Cr |

| Star Health | ₹4,428.1 Cr |

| Metro Brands | ₹3,061.3 Cr |

| Concord Biotech | ₹4,633.1 Cr |

| Baazar Style Retail | ₹73.9 Cr |

| Inventurus Knowledge Solutions | ₹13,685.8 Cr |

He believed in holding quality stocks for the long term, which is evident from his 15+ year journey with Titan.

According to Trendlyne’s latest portfolio data, Rakesh Jhunjhunwala held stakes in top companies like Titan, Star Health, and Tata Motors.

Rakesh Jhunjhunwala Education

He was a qualified Chartered Accountant. He completed his studies from Sydenham College, Mumbai, and later enrolled in the Institute of Chartered Accountants of India (ICAI). His education played a major role in building strong financial and analytical skills, which later helped him in picking winning stocks.

Rakesh Jhunjhunwala Books and Wisdom

While Rakesh Jhunjhunwala didn’t write any books himself, many books have been written about him and his methods. Some popular Rakesh Jhunjhunwala books include:

- “The Big Bull of Dalal Street” – by Mahesh Vyas

- “Rakesh Jhunjhunwala: The Man Who Made Dalal Street Sweat” – by various market writers

- “Rakesh Jhunjhunwala: How the Big Bull of Dalal Street Built a ₹46,000 Crore Empire”

These books offer insights into his investment journey, his approach toward risk, and his belief in India’s economic future.

His favorite quote was:

“The market is always right. It is only us who are wrong.”

Rakesh Jhunjhunwala Death: A Sudden Goodbye

Rakesh Jhunjhunwala death came as a shock on August 14, 2022, at the age of 62. He passed away due to a cardiac arrest, just days after launching his airline, Akasa Air. Despite his health problems, he remained active in the stock market till his last days.

His death left a huge void in the financial world. Investors, business leaders, and politicians expressed deep sorrow, calling him a visionary and patriot.

He passed away on August 14, 2022, in Mumbai. Economic Times covered his death in detail, calling him the “Big Bull” of the Indian markets.

Legacy That Lives On

- Akasa Air: His final venture, a low-cost airline, started operating just before his passing. He was one of its founding investors.

- Inspiration to Retail Investors: He showed that with knowledge, patience, and boldness, even a middle-class Indian can become a billionaire.

- Financial Reforms Supporter: He often spoke openly about government policies, taxation, and reforms that could improve the Indian economy.

Rakesh Jhunjhunwala’s journey from ₹5,000 in 1985 to ₹46,000 crore in 2022 proves the magic of smart investing and believing in India’s growth story. His portfolio choices, disciplined investing, and bold moves continue to inspire millions of Indian investors.

If you’re new to the market and want to learn from the best, start by studying Rakesh Jhunjhunwala books, understand his portfolio strategy, and stay curious—just like he did.

Also Read: Explore Moneyphobia for investing tips, latest stock news, and legendary investor stories

Photo

For Advertising, Guest Posting, Newsletter Inserts please contact [email protected]. For general enquiries contact [email protected].

Recent Posts

Angel One Stock Broker Review

Income Tax Alert: ITR Filing Last Date for FY 2024-25 (AY 2025-26)

TikTok in India: The Buzz, the Ban, and What’s Really Happening

Wordle Answer Today (August 20, 2025): Hints and Full Solution Explained

Google Expands Store in India and Faces Global Play Store Challenges

Ola Electric Shares Recover Strongly After Heavy Fall in 2025

Gold Price Today: Rates Fall as Strong Dollar Impacts Market

Shreeji Shipping Global IPO Sees Strong Demand, GMP Suggests Listing Gains

India Approves ₹62,000 Crore Deal for LCA Tejas Mark 1A, HAL Shares Gain

Mangal Electrical and Gem Aromatics IPOs Draw Investor Attention with Steady GMP

Regaal Resources Makes Strong Market Debut with 39% Premium on Listing Day

Buchi Babu Tournament 2025 Begins with Exciting Performances