Last updated on December 23rd, 2024 at 03:32 pm

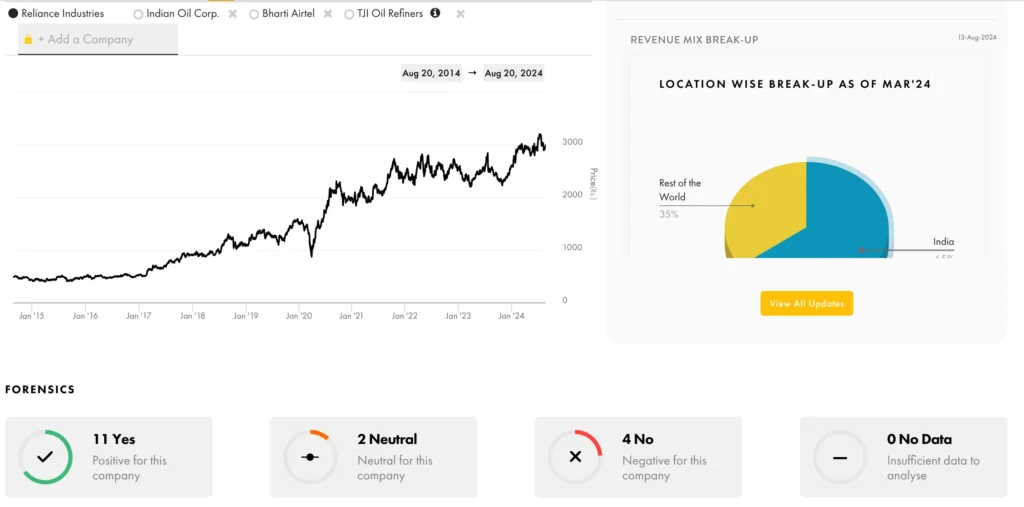

Reliance Industries Ltd Share Price Prediction 2024, 2025, 2026 to 2030 in Future Return?

Reliance Industries Limited (RIL) is one of India’s largest conglomerates, with interests spanning various sectors including petrochemicals, refining, oil & gas exploration, retail, telecommunications, and digital services.

About Reliance Industries Ltd

Reliance Industries Ltd (RIL) is one of India’s largest conglomerates with diversified interests in petrochemicals, refining, oil, telecommunications, retail, and digital services. The company is a leader in several sectors and plays a pivotal role in the Indian economy. RIL is also recognized for its innovation and expansion into new business areas, making it a key player in the global market.

Reliance Industries Share Price Today

Company Details

- Founded: 1973

- Headquarters: Mumbai, India

- Products: Petrochemicals, refining, oil, telecommunications, retail, digital services

- Market Share: Leader in petrochemicals and refining, significant presence in telecom and retail sectors

- Key Clients: Wide range across various sectors globally

Founder Details

Reliance Industries Ltd was founded by Dhirubhai Ambani in 1973. Dhirubhai Ambani was a visionary entrepreneur who started with a small trading business and built it into one of India’s largest and most diversified conglomerates. His entrepreneurial spirit and business acumen laid the foundation for RIL’s growth. After his demise, the company is now led by his son, Mukesh Ambani, who has further expanded the company into new sectors such as telecommunications and digital services.

Promoter

| Name | Stake (%) |

|---|---|

| Ambani Family | 50.52 |

| Institutional Investors | 49.48 |

Reliance balance sheet

| Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | |

|---|---|---|---|---|

| Equity Capital | 6,445 | 6,765 | 6,766 | 6,766 |

| Reserves | 693,727 | 772,720 | 709,106 | 786,715 |

| Borrowings | 278,962 | 319,158 | 451,664 | 458,991 |

| Other Liabilities | 340,931 | 399,979 | 438,346 | 502,576 |

| Total Liabilities | 1,320,065 | 1,498,622 | 1,605,882 | 1,755,048 |

| Fixed Assets | 541,258 | 627,798 | 724,805 | 779,985 |

| CWIP | 125,953 | 172,506 | 293,752 | 338,855 |

| Investments | 364,828 | 394,264 | 235,560 | 225,672 |

| Other Assets | 288,026 | 304,054 | 351,765 | 410,536 |

| Total Assets | 1,320,065 | 1,498,622 | 1,605,882 | 1,755,048 |

Reliance Industries Ltd Share Price Target 2024

Reliance Industries Ltd is expected to continue its robust performance in 2024, driven by its strong presence in various sectors. The company’s focus on expanding its digital services, retail footprint, and refining capacities could propel growth. Additionally, RIL’s strategic partnerships and investments in renewable energy could positively impact its performance.

- Maximum Target: ₹2,900

- Minimum Target: ₹2,500

Reliance Industries Ltd Share Price Target 2025

In 2025, Reliance Industries Ltd may see further growth as it continues to strengthen its telecom and retail businesses. The company’s investments in Jio, its telecom arm, and the expansion of Reliance Retail could drive significant revenue growth. RIL’s entry into the green energy sector may also contribute to its upward trajectory.

- Maximum Target: ₹3,200

- Minimum Target: ₹2,700

Reliance Industries Ltd Share Price Target 2026

The year 2026 could be pivotal for Reliance Industries Ltd, with a focus on innovation and expanding its business horizons. The company’s expertise in petrochemicals, digital services, and retail could lead to increased market share. RIL’s financial stability and diversified business model could result in share price appreciation.

- Maximum Target: ₹3,600

- Minimum Target: ₹3,000

Reliance Industries Ltd Share Price Target 2027

By 2027, Reliance Industries Ltd is anticipated to further solidify its leadership across various sectors. The company’s continued investment in technology, digital transformation, and renewable energy could enhance its competitive advantage. This may result in sustained growth and improved market positioning.

- Maximum Target: ₹4,000

- Minimum Target: ₹3,200

Reliance Industries Ltd Share Price Target 2028

In 2028, Reliance Industries Ltd’s share price may benefit from its emphasis on providing high-quality products and services across its business verticals. The company’s focus on sustainability, innovation, and expansion into new markets could drive long-term growth. RIL’s strong financial performance and diversified portfolio may also support its growth.

- Maximum Target: ₹4,400

- Minimum Target: ₹3,500

Reliance Industries Ltd Share Price Target 2029

As Reliance Industries Ltd continues to innovate and expand, 2029 could see substantial growth. The company’s leadership in the petrochemicals, telecom, and retail sectors may attract more investors. RIL’s strong client relationships and strategic initiatives could contribute to revenue growth.

- Maximum Target: ₹4,800

- Minimum Target: ₹3,800

Reliance Industries Ltd Share Price Target 2030

Looking towards 2030, Reliance Industries Ltd is expected to be a dominant force in the Indian and global markets. The company’s comprehensive service offerings and strong financial performance may drive significant share price appreciation. RIL’s commitment to sustainability, innovation, and excellence could result in continued success.

- Maximum Target: ₹5,200

- Minimum Target: ₹4,000

Reliance Industries Ltd Share Price Target 2035

By 2035, Reliance Industries Ltd may achieve new milestones in various sectors. The company’s focus on emerging technologies, strategic expansion plans, and commitment to quality could result in substantial returns for investors. RIL’s strong market position and reputation for delivering innovative solutions may continue to drive growth.

- Maximum Target: ₹6,500

- Minimum Target: ₹5,000

| Year | Minimum Target (INR) | Average Target (INR) | Maximum Target (INR) |

|---|---|---|---|

| 2024 | 3,000 | 3,250 | 3,500 |

| 2025 | 3,500 | 3,750 | 4,000 |

| 2026 | 4,000 | 4,250 | 4,500 |

| 2030 | 5,000 | 5,500 | 6,000 |

| 2040 | 7,000 | 8,000 | 9,000 |

| 2050 | 8,000 | 9,000 | 10,000 |