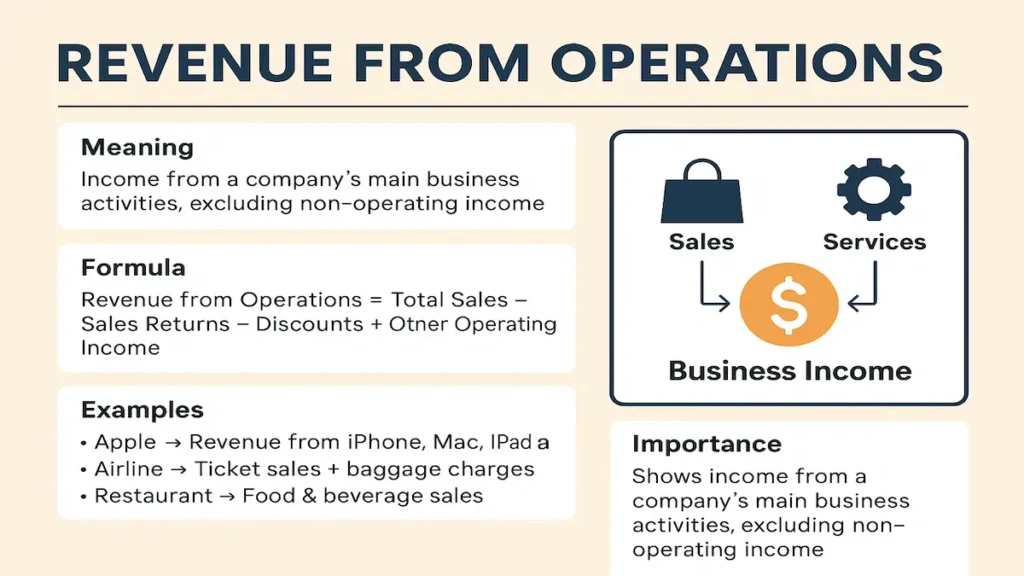

Revenue from Operations is one of the most important figures in a company’s financial statements. It shows how much money a business earns from its main activities. This number does not include income from investments, asset sales, or any non-core activities. It reflects only the money generated from the company’s primary business.

In simple terms, it is the revenue from selling goods or providing services that are part of the main business. If you want to understand how well a company is doing in its main line of work, this is the figure to look at.

What Does Revenue from Operations Include?

The exact items included will depend on the type of business.

- For a manufacturing company: It includes sales of products it produces, after subtracting returns and discounts.

- For a service provider: It includes the fees charged for services.

- For a retailer: It includes sales of merchandise.

Some additional items can also be counted as part of revenue from operations if they are related to the core business. This may include:

- Export incentives.

- Service charges.

- Royalties from core products or services.

You can read our guide on Types of Revenue in Business to learn about the different kinds of income a company can have.

What It Does Not Include

Revenue from operations excludes income from non-core activities. These are often listed under “Other Income” in financial statements. Examples include:

- Interest earned from bank deposits.

- Sale of fixed assets.

- Dividends from investments.

- Rental income from property not related to main business operations.

For a better understanding of how these numbers appear in company filings, check our article on How to Read a Company’s Income Statement.

Formula for Revenue from Operations

The general formula is:

Revenue from Operations = (Total Sales – Sales Returns – Discounts) + Other Operating Income

Here, “Other Operating Income” refers to income directly related to the main business, not unrelated sources.

If you are learning about business analysis, you should also explore our post on Operating Profit Margin to see how revenue links to profitability.

Examples of Revenue from Operations

Let’s look at some real-world examples:

- Apple Inc.: Revenue from iPhone, Mac, iPad, and related services. This does not include gains from selling buildings or interest from investments.

- Airline Company: Ticket sales and baggage charges. Not interest from bank accounts.

- Restaurant: Sales from food and drinks. Not rental income from leasing part of the property.

These examples show that the focus is always on the main business activities.

For more examples with real company data, you can check our detailed guide on Annual Reports Analysis.

Why Revenue from Operations Matters

- Shows Core Business Strength

Investors want to see if the company’s main business is growing. A rise in revenue from operations means the company is selling more or charging higher prices. - Helps Compare Companies

Two companies in the same industry can be compared using this figure. This allows investors to see who is performing better in the market. - Removes Non-Core Distortions

Non-operating income can create a misleading picture. By focusing on operational revenue, you get a clearer view of the real performance.

If you want to know more about how investors evaluate companies, read our post on Fundamental Analysis for Beginners.

Revenue from Operations in Financial Statements

In most income statements, revenue from operations is shown at the top. It is the first number before other income is added. Analysts and investors often track this number over several quarters or years to see trends.

If the number is rising steadily, it usually means the business model is working. If it is falling, the company may need to improve sales or adjust its pricing strategy.

You can also explore our guide on Board of Directors’ Role in Financial Oversight to see how company boards monitor such figures.

In summary, revenue from operations tells you how much money a business earns from its core activities. It is a key measure for evaluating business performance and is closely watched by investors, analysts, and company management. Understanding this figure can help you make better investment and business decisions.

Recent Posts

Important Bank Holiday Trading Hours Update – January & February 2026

Tata Power-DDL launches Solar Sakhi Abhiyan

Next-Gen GST Reform: A Historic Diwali Gift for the Nation

Angel One Stock Broker Review

Income Tax Alert: ITR Filing Last Date for FY 2024-25 (AY 2025-26)

TikTok in India: The Buzz, the Ban, and What’s Really Happening

Wordle Answer Today (August 20, 2025): Hints and Full Solution Explained

Google Expands Store in India and Faces Global Play Store Challenges

Ola Electric Shares Recover Strongly After Heavy Fall in 2025

Gold Price Today: Rates Fall as Strong Dollar Impacts Market

Shreeji Shipping Global IPO Sees Strong Demand, GMP Suggests Listing Gains

India Approves ₹62,000 Crore Deal for LCA Tejas Mark 1A, HAL Shares Gain

2 thoughts on “Revenue from Operations: Meaning, Examples, and Importance {update}”