Indian stock markets closed lower on July 31, 2025. The day started with a sharp fall after the announcement of new U.S. tariffs on Indian imports. U.S. President Donald Trump said that a 25 percent tariff will be imposed on Indian goods from August 1. The news created panic in the market in the morning session.

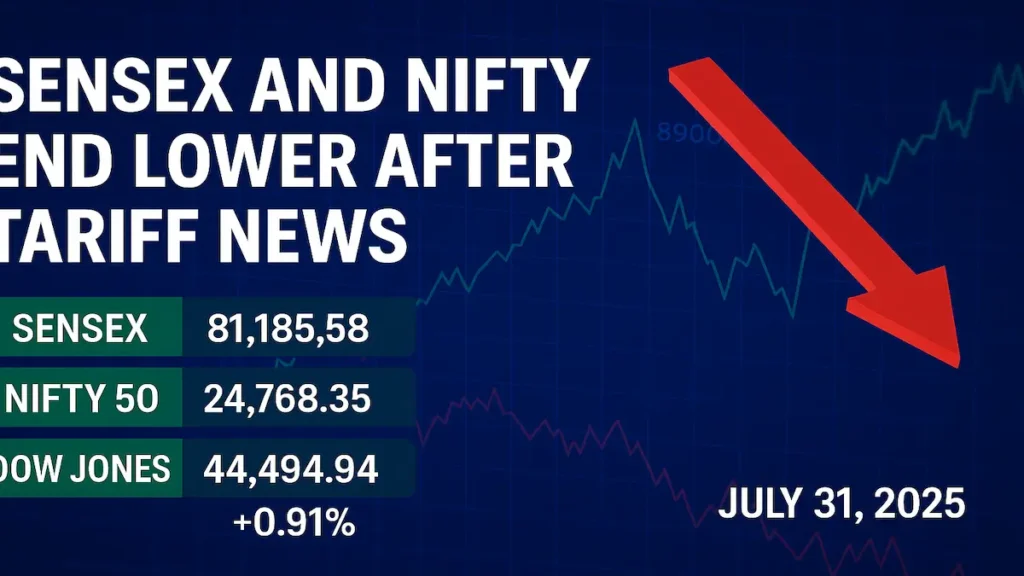

The BSE Sensex ended at around 81,185.58 points. It fell by about 296 points or 0.36 percent from the previous close. The Nifty 50 also slipped and closed at 24,768.35 points. It was down by 87 points or 0.35 percent. The selling pressure was seen mainly in banking and IT stocks. HDFC Bank shares fell by 0.34 percent, which added to the weakness in Sensex.

The day began with a strong fall. Within 15 minutes of trading, investors lost over Rs 5 lakh crore in market value. However, the markets recovered some losses as traders felt that the tariff move could be a negotiation tactic by the U.S. The Sensex managed to cut down its early losses by the closing session.

Market Drivers

The main reason for the fall was the tariff announcement. The U.S. government linked the decision to India’s purchase of Russian oil and defense supplies. This created fresh concerns about India-U.S. trade relations. Investors feared that this could affect export-related sectors like IT and manufacturing.

Despite the weakness in Indian markets, some stocks showed positive moves. Maruti Suzuki India shares gained about 0.10 percent and outperformed the broader market. Other auto stocks also managed to hold steady.

Global Market Performance

While Indian markets were weak, U.S. markets performed better. The Dow Jones Industrial Average closed higher at around 44,494.94 points. It gained 400 points or about 0.91 percent. The rise in Dow Jones was supported by strong earnings in U.S. companies and a rally in technology stocks.

Positive global sentiment limited further selling in Indian markets. Traders also looked at GIFT Nifty, which trades Indian indices in dollars. It showed mixed trends during the day as global investors tracked both U.S. and Indian developments.

Key Levels and Summary

| Index | Level | Change |

|---|---|---|

| Sensex (BSE) | 81,185.58 | –0.36% (–296 pts) |

| Nifty 50 (NSE) | 24,768.35 | –0.35% (–87 pts) |

| Dow Jones (USA) | 44,494.94 | +0.91% (+400 pts) |

The market reaction shows that global factors still play a strong role in Indian equities. Any big policy move by the U.S. can impact investor sentiment. Traders should be careful in the coming sessions. If the tariff issue continues, sectors that depend on exports may face more pressure.

Moneyphobia suggests investors track news on trade talks closely. Short-term volatility can be high. Long-term investors should focus on quality stocks with strong fundamentals. It is important to avoid panic selling in such situations.

The next trading sessions will be important to see if the market can recover. Global cues from the U.S. and any update on tariffs will guide the movement of Sensex and Nifty.

For Advertising, Guest Posting, Newsletter Inserts please contact [email protected]. For general enquiries contact [email protected].