Last updated on December 23rd, 2024 at 03:34 pm

Invest in Swiggy IPO: Analyze Swiggy’s growth, revenue, and profitability potential before IPO and post-listing for long-term gains in food-tech.

About Swiggy Limited

Swiggy is one of the biggest online food delivery and quick commerce companies in India that enables millions of customers to get connected with restaurants & other service providers. Swiggy has opened new business sectors namely Swiggy Instamart – grocery delivery within 15 minutes and Swiggy Genie, delivering errands and parcel. This IPO is intended for Swiggy’s development strategy, increase its market share, and improve technologies and facilities.

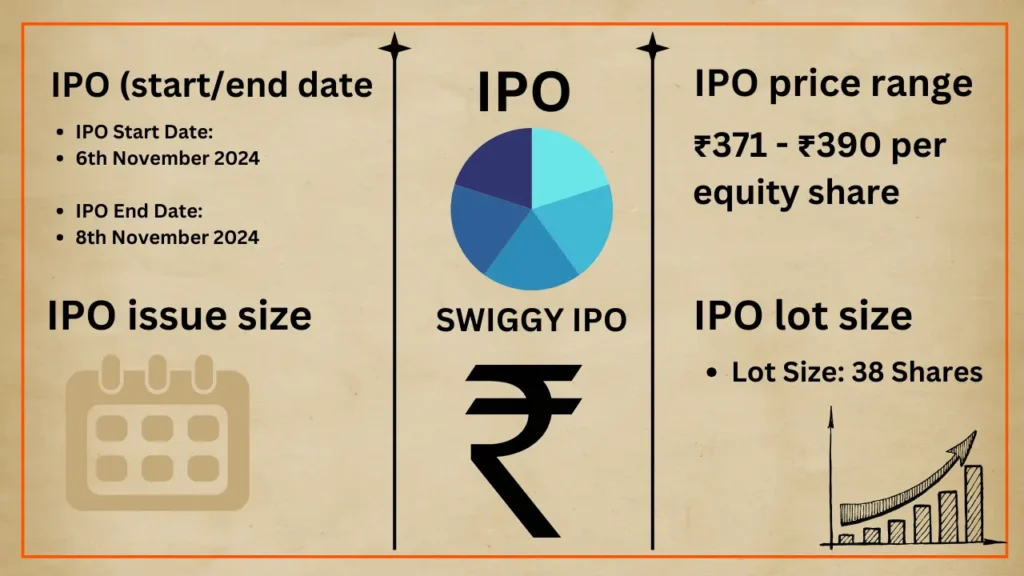

IPO Details

- IPO Start Date: 6th November 2024

- IPO End Date: 8th November 2024

- Issue Price: ₹371 – ₹390 per equity share

- Face Value: Re. 1 per equity share

- Lot Size: 38 Shares

- Total Issue Size: Fresh Issue of up to ₹44,990 million and an Offer for Sale of up to 175,087,863 equity shares (including Anchor Allocation of 130,385,211 equity shares)

- Discount: ₹25 per equity share discount for eligible employees in the Employee Reservation Portion

- Maximum Subscription for Retail Investor: ₹2,00,000

- Maximum Subscription for Employee Category: ₹5,00,000

- Status: 100% Book Building

GMP Price (Grey Market Premium)

As of Today, the GMP(Gray Market Price) of Swiggy Limited’s IPO GMP is ₹1.

Promoters

Financial Summary

Here’s the financial summary for Swiggy Limited based on the latest data:

- Revenue from Operations: Swiggy’s revenue increased significantly, reaching INR 112,473.90 million in FY 2024, up from INR 82,645.96 million in FY 2023, indicating strong growth driven by the Food Delivery, Quick Commerce, and other service segments.

- Swiggy Platform Gross Revenue: For FY 2024, the consolidated gross revenue across Swiggy’s platforms amounted to INR 123,203.14 million, showing substantial expansion across all business areas.

- Adjusted EBITDA: Swiggy’s consolidated adjusted EBITDA improved from a loss of INR 39,103.37 million in FY 2023 to INR 18,355.67 million in FY 2024, highlighting improvements in cost efficiency across its services.

- Net Loss: Swiggy reported a net loss of INR 23,502.43 million in FY 2024, a reduction from the previous year’s loss of INR 41,793.05 million. This reflects Swiggy’s ongoing efforts to reduce costs, though losses remain due to high expenditures in growth and expansion.

- Operational Cash Flow: Net cash used in operating activities decreased to INR 13,127.35 million in FY 2024, down from INR 40,599.09 million in FY 2023, showing an improvement in operational cash handling

Pre-IPO Investment Considerations

Recommendation: Before IPO, Swiggy seems very attractive to those willing to invest in high growth companies without profitability at the moment, especially those who are willing to wait long and who do not get easily scared by risk. The current financial model enjoys fast growth, and thus potential investors should expect fluctuating results because the stake invests heavily in growth and therefore shows negative indicators of profitability for now.

Post-Listing Investment Considerations

Recommendation: After the listing, Swiggy might be more appropriate for those investors, who are ready to look at the future and who are not afraid of high fluctuations in the technology industry. The listing price will be the most important observation since entering the market after the first fluctuations might be a wiser move if the price will not go up and down too frequently from then on.

Overall Investment Remark:

- Pre-IPO: Buy if you have a high risk appendage and endorse Swiggy as a long-term play.

- Post-Listing: They should therefore compare the listing price and the market reaction with the idea that the appropriate horizon of an IPO investment is longer than the traditional one, given Swiggy’s growth stage and current financial situation.

Stay updated on CDSL’s growth, financial results, and more by following Moneyphobia.in for reliable, detailed finance news and analysis.