Last updated on December 23rd, 2024 at 03:44 pm

Varroc Engineering Ltd Share Price Prediction 2024, 2025, 2026 to 2030 in Future Return In this post, Varroc Engineering Ltd is a leading global automotive component manufacturer providing cutting-edge technology and innovative solutions to the automotive industry.

Varroc Engineering Share Price Today

About Varroc Engineering Ltd

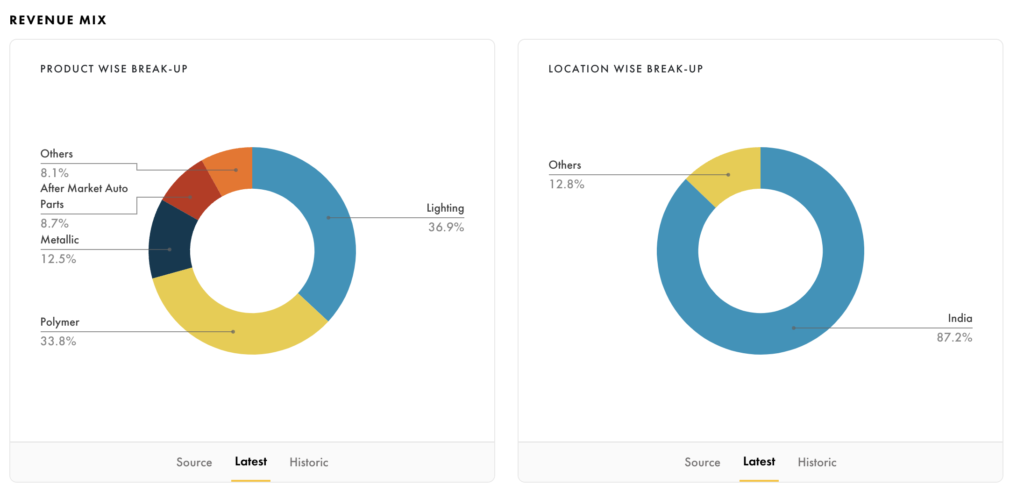

The company specializes in manufacturing and supplying a wide range of automotive components, including exterior lighting systems, powertrains, and electronic systems. Varroc Engineering has a strong presence in key automotive markets across the globe, serving leading automotive original equipment manufacturers (OEMs).

Company Details

- Founded: 1990

- Headquarters: Aurangabad, India

- Products: Automotive lighting systems, powertrains, electronic systems, and other components

- Market Share: Significant player in the global automotive components industry

- Key Clients: Leading automotive OEMs globally, including major car and motorcycle manufacturers

Founder Details

Varroc Engineering Ltd was founded by Tarang Jain in 1990. Tarang Jain, a visionary entrepreneur, established the company with the aim of becoming a leading supplier of automotive components to the global market. Under his leadership, Varroc Engineering has grown into a multinational corporation, expanding its operations and product portfolio to meet the evolving demands of the automotive industry. Tarang Jain’s focus on innovation and excellence has been instrumental in the company’s success.

Promoter

| Name | Stake (%) |

|---|---|

| Tarang Jain & Family | 68.5 |

| Institutional Investors | 31.5 |

Varroc Engineering Ltd Share Price Target 2024

Varroc Engineering Ltd is expected to continue its growth trajectory in 2024, driven by its strong presence in the automotive components industry. The company’s focus on innovation, quality, and customer satisfaction could enhance its market share. Additionally, Varroc Engineering’s strategic partnerships and expansion into new markets may contribute to its growth.

- Maximum Target: ₹700 – ₹800

- Minimum Target: ₹350

Source – Moneyphobia

Varroc Engineering Ltd Share Price Target 2025

In 2025, Varroc Engineering Ltd may see further growth as it continues to innovate and expand its product offerings. The company’s investments in advanced automotive technologies and sustainable solutions could drive demand. Varroc Engineering’s focus on enhancing its global footprint and strengthening customer relationships may also boost its performance.

- Maximum Target: ₹800 – ₹900

- Minimum Target: ₹400

Varroc Engineering Ltd Share Price Target 2026

The year 2026 could be significant for Varroc Engineering Ltd, with a focus on expanding its market reach and product innovation. The company’s expertise in automotive components and its strategic initiatives could lead to increased market share. Varroc Engineering’s financial stability and diversified product portfolio could contribute to share price appreciation.

- Maximum Target: ₹900 – ₹1000

- Minimum Target: ₹450

Learn Extra

Mphasis Ltd Share Price Target 2024

Coforge Ltd Share Price Target 2025

Varroc Engineering Ltd Share Price Target 2027

By 2027, Varroc Engineering Ltd is anticipated to further solidify its position in the global automotive components industry. The company’s continued investment in technology, research and development, and customer satisfaction could enhance its competitive advantage. This may result in sustained growth and improved market positioning.

- Maximum Target: ₹1000 – ₹1200

- Minimum Target: ₹500

Varroc Engineering Ltd Share Price Target 2028

In 2028, Varroc Engineering Ltd’s share price may benefit from its emphasis on providing high-quality automotive components and solutions. The company’s focus on innovation, sustainability, and expansion into new markets could drive long-term growth. Varroc Engineering’s strong financial performance and diversified product offerings may also support its growth.

- Maximum Target: ₹1000 – ₹1500

- Minimum Target: ₹550

Varroc Engineering Ltd Share Price Target 2029

As Varroc Engineering Ltd continues to innovate and expand, 2029 could see substantial growth. The company’s leadership in the automotive components industry and its strategic initiatives may attract more investors. Varroc Engineering’s strong client relationships and commitment to quality could contribute to revenue growth.

- Maximum Target: ₹950

- Minimum Target: ₹600

Varroc Engineering Ltd Share Price Target 2030

Looking towards 2030, Varroc Engineering Ltd is expected to be a dominant force in the global automotive components market. The company’s comprehensive product offerings and strong financial performance may drive significant share price appreciation. Varroc Engineering’s commitment to innovation, sustainability, and excellence could result in continued success.

- Maximum Target: ₹1,050

- Minimum Target: ₹650

Varroc Engineering Ltd Share Price Target 2035

By 2035, Varroc Engineering Ltd may achieve new milestones in the automotive components industry. The company’s focus on emerging technologies, strategic expansion plans, and commitment to quality could result in substantial returns for investors. Varroc Engineering’s strong market position and reputation for delivering innovative solutions may continue to drive growth.

- Maximum Target: ₹1,300

- Minimum Target: ₹800