The Indian stock market had a stellar day on January 2, 2025, as benchmark indices Sensex and Nifty ended with significant gains. The Sensex soared over 1,500 points, while the Nifty comfortably crossed the 24,200 mark. This rally comes despite weak cues from Asian markets, reflecting strong domestic momentum.

Key Highlights of the Market Rally

- Sector-Wise Performance:

Twelve out of the thirteen major sectors gained today. The financial sector rose by 0.4%, with private banks seeing a 0.5% jump. The Nifty IT sector also gained nearly 2%, driven by strong performances from Infosys and HCL Technologies. Meanwhile, Nifty Bank rallied over 1%, with Kotak Mahindra Bank leading the gains. - Stock Performances:

- Kotak Mahindra Bank surged 2% after Citi and Jefferies upgraded it to a “buy.”

- Infosys led the IT pack with a 3.71% gain, followed by HCL Technologies at 2.37%.

- Midcap and small-cap stocks continued their upward march, adding breadth to the rally.

- December Auto Sales Boost:

Strong auto sales data for December 2024 supported the rally. Investors showed confidence in the auto sector, which is seen as a key growth driver in the current economy. - Liquidity and Stability in Financials:

Brokerages like Jefferies and Citi highlighted stable asset quality in the financial sector, pointing out that pressures on banks may ease in 2025. This optimism fueled buying in banking and financial stocks. - Expiry Day Buying:

The market also saw robust buying activity due to the expiry of weekly options. This further pushed both indices higher during the trading session.

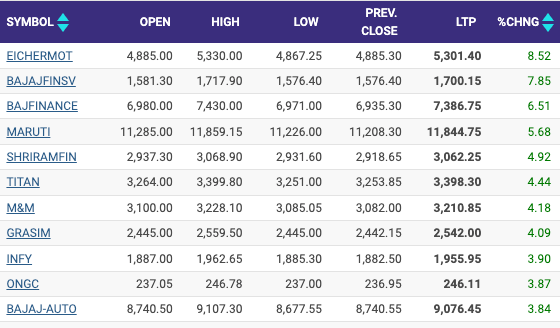

NIFTY 50 Top Gainer Today

Additional Developments

- Market Capitalization Increse:

The total market cap of BSE-listed companies increased by ₹5.58 lakh crore, reaching ₹450.01 lakh crore. - Global Cues:

European markets opened 2025 with modest gains. The STOXX 600 index rose 0.3% on the day, reflecting stability despite inflationary concerns. - IPO Buzz:

Capital Infra Trust’s InvIT IPO is set to open on January 7, with a price band of ₹99-₹100 per unit. Reliance Jio’s massive IPO plan, targeting ₹40,000 crore, also kept investors excited. - VIX Decline:

India VIX, the volatility index, eased by more than 5%, indicating reduced market fear and improved investor sentiment.

Expert Insights

According to market expert Seshadri Sen, financial stocks are entering a period of stability after shocks from Q2 2024 earnings. While immediate recovery may take time, the absence of further shocks provides a positive outlook for the near term.

Future Outlook

Analysts at Antique Stock Broking have set an ambitious Nifty 50 target of 26,500 by March 2026. The bull run is expected to be fueled by factors like government capex, growth in mid-cap stocks, and shifts in key sectors. Top stock picks for this rally include Bharti Airtel, ICICI Bank, Hindustan Aeronautics, Godrej Properties, and Marico.

Today’s rally shows the resilience of the Indian stock market. Strong domestic cues, supported by optimistic global trends, indicate a promising start to 2025. As earnings season approaches, investors will be closely watching corporate results and global developments. For now, the sentiment remains bullish, with market experts advising selective buying in fundamentally strong stocks.

Stay updated with the latest market insights and trends on Moneyphobia.